Bundll: a New Pay Later Tool Unveiled

FACTS

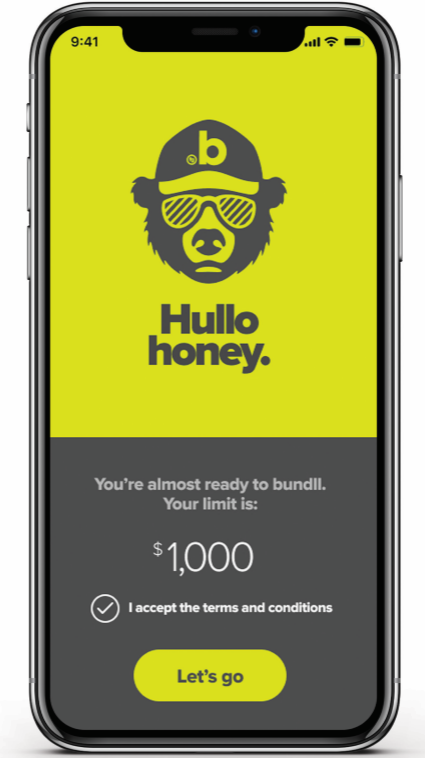

- After releasing their results, the Australian financial service provider, Flexigroup, unveils “Bundll”: a Mastercard-linked Pay Later product to launch in the end of 2019.

- Bundll relies on a Buy Now, Pay Later option and companion Mastercard virtual debit card for purchases up to $1,000. Customers may pay back within 15 days.

- How it works.

- Customers subscribe in-app and are provided with a virtual card

- The card can be paired with a digital wallet, including Apple Pay or Google Pay

- No account-keeping fees are applied; and this option is interest-free

- Each week, Bundll-based transactions are aggregated (within the limit assigned when opening the account): the users then have two weeks to pay back

- No prior credit score verification but self-reported information let them define the customer’s available budget.

- Customers may delay their payments and get an extra two weeks to settle their transaction (an option charge $5).

- They may also pay back in 6 instalments over 3 months (an option charged 5% of the amount they need to spread).

CHALLENGES

- Targeting Millennials. Bundll is mostly intended for Millennials, interested in flexible, instantly available payment options.

- Standing out from competition. Bundll is meant for everyday purchases (food, outings, transportation), unlike other services, such as Afterpay, rather intended for large-amount or occasional purchases. This service builds on a free Pay Later feature and a credit facility to favour flexibility.

- Building their position. Based on a partnership with Mastercard, Flexigroup adds further credibility to their product, and has access to a global acceptance network: an actual lever for securing Australian customers’ loyalty.