BPCE mutualizes network computing

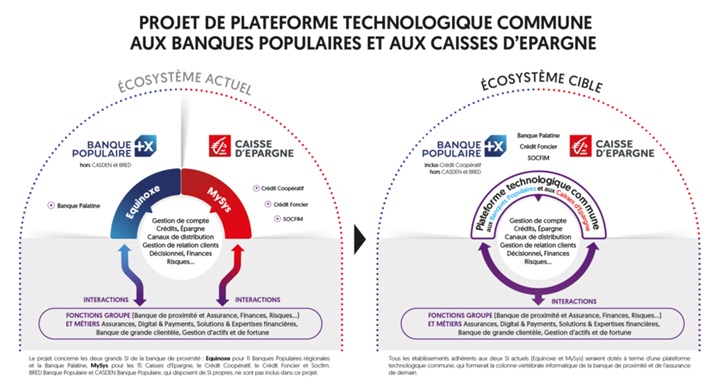

The group COPD the publication of its results financial resources. Attesting to financial health, BPCE also took the opportunity to announce a profound strategic transformation within its group. This operation concerns the unification of the computer systems of its Popular banks and Savings.

FACTS

- The IT systems of Banques Populaires and Caisses d'Epargne will soon have to be one. The BPCE Group has just announced the launch of a project for a common technology platform for its two networks.

- After a year of preparatory work, this vast project is planned to take place within 4 years. To the key:

- more personalised services for group customers,

- better technical quality of offers and systems,

- an improved experience for the group's employees.

- The cost of this reorganization and mutualisation operation is estimated at around €750 million.

ISSUES

- Achieving economies of scale : The sharing of the computer systems of the two networks of Banques Populaires and Caisses d'Epargne is primarily motivated by a financial interest. The BPCE group as a whole hopes that this rationalization will enable it to achieve medium-term savings within 4 years according to its prognosis.

- Continue its strategic plan : It was in 2024 that the BPCE group presented its plan VISION 2030, a new strategic line that today guides a large majority of its actions. On several themes, since the VISION 2030 plan covers both the ambitions of BPCE in terms of carbon neutral, of diversification and, as is the case today, of larger-scale strategic reorganization.

- Ensuring its transformation BPCE believes that this pooling should help it meet the new technological challenges currently facing the banking sector and its necessary transformation in the areas of payment modernization, digitized services, implementation of AI technologies and enhancement of cybersecurity.

PERSPECTIVE

- While the BPCE group is now seeking to save new money on these computer systems, this strategic decision comes after two difficult fiscal years, but above all, after the group has regained some financial health.

- BPCE also announced these good results for the year 2024, particularly with an increase in its net income of 140% in the fourth quarter.

- In any event, the current decision of the BPCE group on the sharing of these computer systems comes after that of a general company in the case of merge with the Crédit du Nord. In any case, it highlights a strategic axis taken by the large French banks in order to achieve economies of scale.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate