BNP Paribas chooses Libeo for invoice digitization

After two years of preparatory work in collaboration with the bank, Libeo has won a major partnership with BNP Paribas. The fintech specialising in the management and payment of corporate invoices has just been selected as a partner by BNP Paribas for its electronic invoice solution.

FACTS

-

BNP Paribas and the start-up Libeo announced on Tuesday a partnership to allow the bank's corporate clients to benefit from Libeo's services for the management of their electronic invoices.

-

This partnership will concern all the clients of BNP Paribas' cash management entity. SMEs and ETIs are primarily concerned. BNP Paribas should recommend Libeo's solution to its customers with a turnover of more than 5 million euros.

-

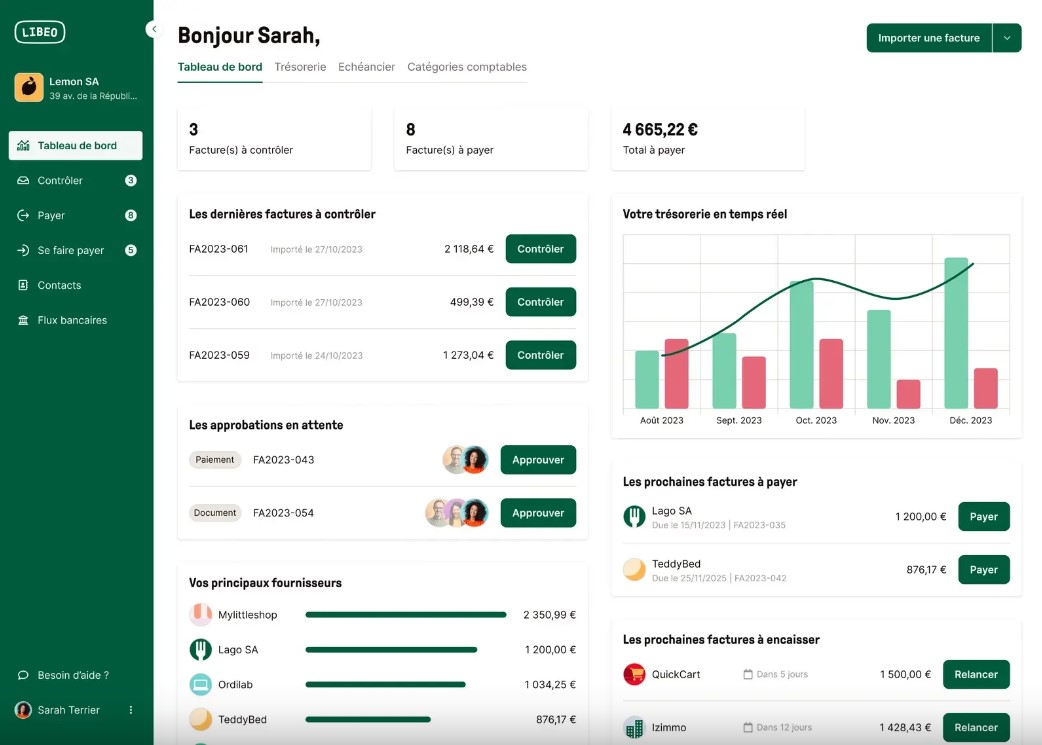

The aim is to be able to receive, manage and pay electronic invoices within a centralised platform. BNP Paribas' instant payment API is also added to Libeo to facilitate payments.

-

The two partners are also communicating on the practical and legal aspects of compliance for businesses, notably through webinars.

-

Watch the video

CHALLENGES

-

Meeting the compliance deadlines: The roll-out of the e-invoicing obligation will be gradual, taking into account the size of companies. Electronic invoicing will apply :

-

as of 1 July 2024, for incoming payments to all taxable persons and, for outgoing payments, to large companies,

-

from 1 January 2025, for medium-sized companies,

-

from 1 January 2026, to small and medium-sized enterprises and microenterprises.

-

The roll-out of the obligation to transmit data to the administration will follow the same schedule.

-

-

Distinguish between electronic invoices and dematerialised invoices: It should be noted that electronic invoices, in the sense of this reform, are not simply dematerialised invoices. It follows a very specific format, which is standardised and requires transit through a portal certified by the State.

-

A reform aimed at interoperability: There will no longer be any direct transmission between customers and suppliers. Instead of a single portal, the tax authorities will subcontract the management of the platforms to operators who will have to obtain registration, known as PDPs (Platforms for Dematerialisation Partners), or to management software (ERP, accounting, etc.) offering unregistered dematerialisation services, known as ODs (Dematerialisation Operators), in accordance with a scheme for the transmission of invoices and data known as the "Y scheme".

MARKET PERSPECTIVE

-

Libeo plans to be registered by the tax authorities (DGFIP) as a PDP, i.e. a trusted third party meeting the regulatory requirements.

-

For the moment, no player has yet obtained certification, with the first registrations expected at the end of 2023. Its alliance with Docaposte last September, a subsidiary of La Poste specialising in "digital trust" services (electronic signature, digital identity, secure data storage, etc.), should give Libeo a competitive advantage.

-