1POINT6 obtains accreditation and signs its first client

1POINT6, the all-in-one payment solution for marketplaces originally created under the name Panto, has obtained its first authorisation from the ACPR. This is an important milestone that has come quickly after its launch. Backed by BNP Paribas, for whom it currently operates as an agent, 1POINT6 is aiming to become a leading fintech in Europe before long.

FACTS

-

1POINT6, a start-up launched in October 2023 under the name Panto, has announced that it has obtained payment agent status. At the same time, the start-up has signed up its first customer.

-

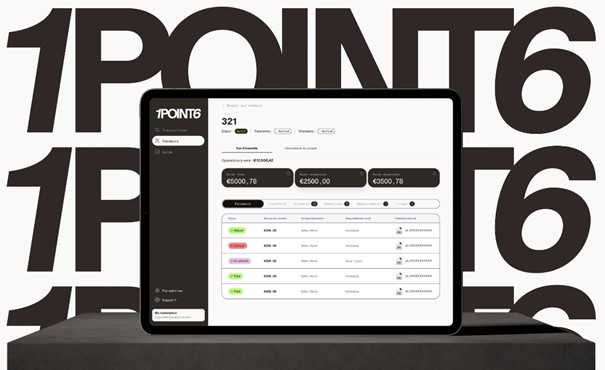

The result of a partnership between Studio 321 and BNP Paribas, 1Point6 is a payment platform for marketplaces. It offers all the functions needed to operate payments on platforms, with :

-

API integration functionality;

-

Cash in functionality (acceptance of multiple payment methods);

-

Cash out functionality (automatic redistribution of payments to sellers, etc.);

-

Automated seller onboarding (with AI-powered KYC process);

-

Management functions with a global view of payments, refunds, etc.; Anti-fraud functions;

-

Anti-fraud functionalities.

-

-

After a rapid launch phase, the start-up obtained its agent status for the provision of payment services from the ACPR this week. This enables it to manage collections on behalf of third parties, seller onboarding and transactions.

-

1POINT6 relied on BNP Paribas to obtain this status, so it acts on the bank's behalf as an agent, under a mandate to provide payment services.

-

The start-up took advantage of this step to sign up its first customer and begin its marketing phase. The customer is My Pizza, a marketplace-based franchise in western France. The customer is already using the 1POINT6 solution, particularly for transaction management.

-

According to the start-up, discussions are also underway with other European marketplaces.

CHALLENGES

-

Dazzling growth: Thanks to its link with BNP Paribas, the fintech was able to benefit from significant support, reducing the technical development time for the platform. Six months after its creation, the start-up has announced that it is operational and ready to meet the needs of marketplaces. It has also reportedly started the process of obtaining the status of Electronic Money Institution (EME).

-

A determination to grow and a strong ambition: 1POINT6 wants to continue in the same vein, marketing its solution as successfully as it has developed technically. It has also stated its ambition to become, within the next four years, the benchmark fintech in Europe for helping marketplaces manage their payments.

MARKET PERSPECTIVE

-

However, 1POINT6 will have to contend with players who are already well established. Mangopay and Lemonway, for example, have been established for several years and offer a variety of solutions on all types of marketplace (B2B, B2C, C2C). BNP Paribas will therefore not be in a position to help the start-up keep up with its competitors.

-

Despite this, the fintech's plan remains unchanged since its creation. The aim is to take advantage of the growth of marketplaces, the current drivers of e-commerce, by offering a comprehensive, secure solution that provides a global view of the business and innovative payment solutions.